by Richelle Smith, Manager of Surety Service and Program Development, Main Street America Insurance

When you’re starting a business, figuring out how to get a surety bond can be confusing and often become an afterthought. Fortunately, independent insurance agents are here to help you understand the difference between being bonded vs. insured, as well as determine what type of bond your business needs and help you navigate every step of the way.

Bonded vs. Insured

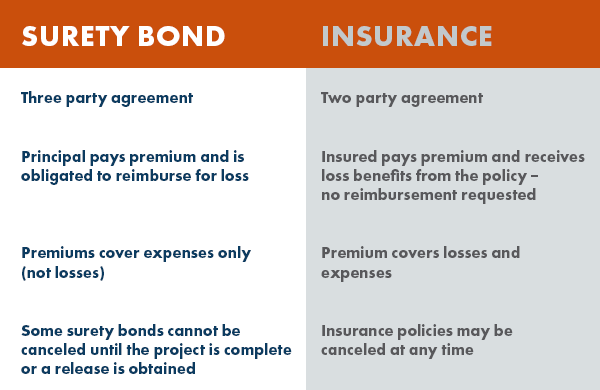

What’s the difference between a surety bond and insurance? It’s actually pretty simple:

As you can see from the image above, there are important differences between surety bonds and insurance. Surety Bonds:

- Are a three party agreement between the Principal, Surety Company, and Obligee (entity requiring the bond).

- Require the Principal to pay the premium and they are expected to reimburse for a loss.

- Premiums cover expenses only (not losses).

- Some surety bonds cannot be canceled until the project is complete or a release is obtained.

In contrast, insurance:

- Is a two party agreement between the insured and the insurance carrier.

- Require the Insured to pay the premium, and they receive loss benefits from the policy. No reimbursement by the Insured is requested.

- Can be canceled at any time.

How Long Does it Take to Get a Bond?

The process of obtaining a bond is faster and simpler than most people think. In fact, depending on the type of bond you need, your independent agent has the ability to visit the Main Street America website and issue a bond in minutes. Other bond types require underwriting and could take anywhere from a couple days to a week to complete, so it’s best to start the process as quickly as possible.

You may be asking yourself “how much does it cost to get bonded?” Well, much like the timeframe and underwriting, premiums can vary significantly. A lot of factors, like risk, bond amount and bond term, can affect how much you’ll pay in premiums. An independent agent can help you determine the exact amount you can expect to pay for your surety bond.

How Do I Know if I Need to Be Bonded?

Here are a few of the most common bond situations you may find yourself in:

- Notary Public Bond: Are you applying to be a Notary to have the ability to notarize documents? Many states require a bond for this.

- Business Services Bond: Is your business one that goes into other people’s homes or businesses to perform a job? You may be required to have this third-party dishonesty bond.

- ERISA Bond: Does your company provide its employees with a pension or 401(k) plan? The IRS will require you also have an ERISA Bond.

- Probate Bond: If you are appointed to act as an administrator, conservator, or guardian of a minor or incapacitated adult, a probate bond may be required by the court.

- License and Permit Bond: Are you a contractor performing a job in a new city? Many cities require various license and permit bonds.

If you’ve been told you need to be “licensed and bonded” and don’t know where to begin, Main Street America Insurance independent agents can help you secure bonding. By answering these simple questions, an agent should quickly be able to recognize what type of bond it is that you’re needing:

- Who is requiring the bond?

- What type of business do you have?

- Have you been provided a required bond form?

For contractors, many cities and states have their own license and permit bond requirements that you will be required to meet. You can find out what those requirements are by speaking to city or state officials, or your independent insurance agent.